Tech and titans – are the big players taking over?

It can sometimes feel as if travel, and self-catering accommodation in particular, is being entirely taken over by an increasingly smaller number of companies. Owners who want to retain control of their businesses but still need to operate at high levels of occupancy might feel like they have no choice other than to sign up with the major names in the industry.

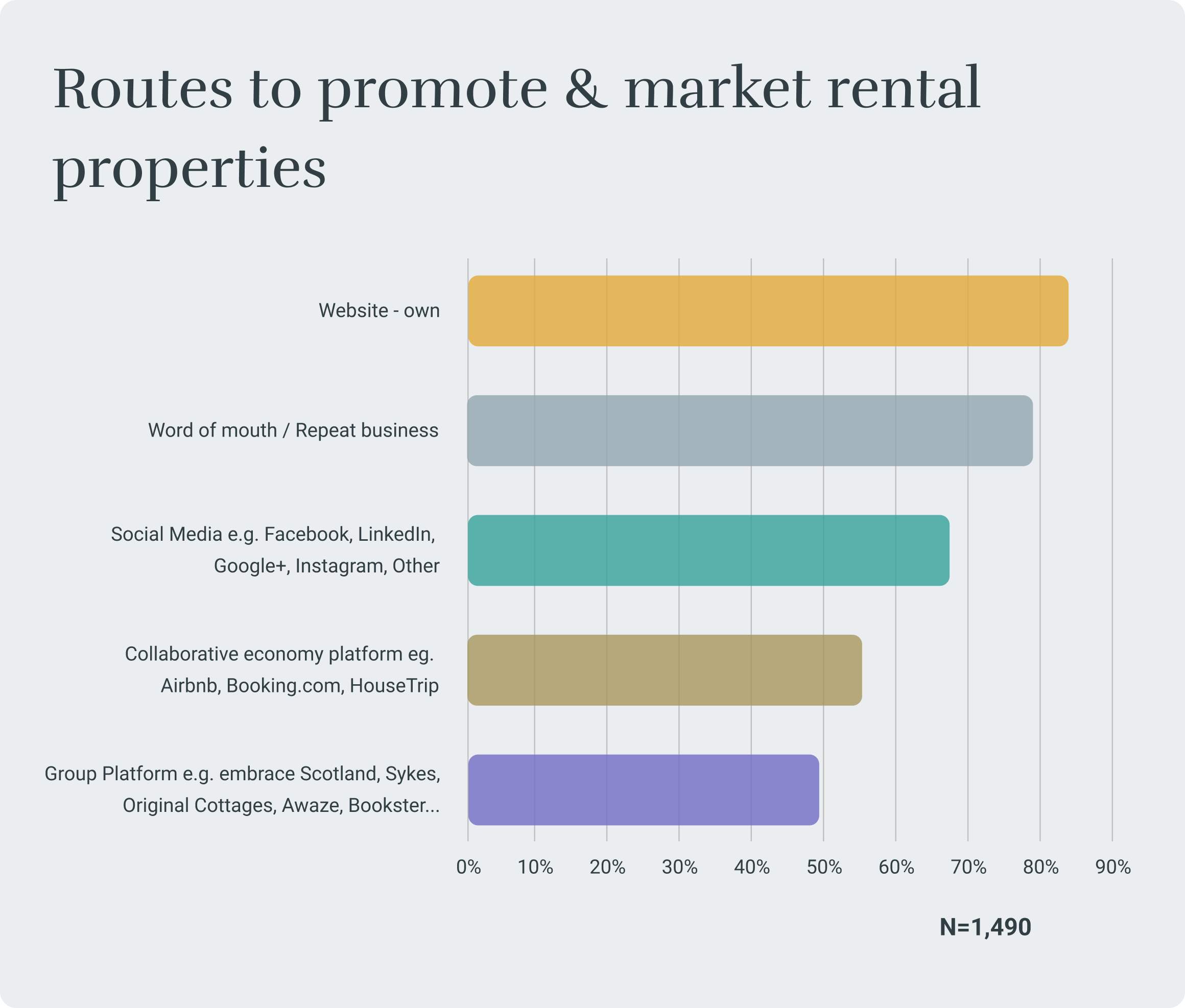

Recently, however, we’re seeing the hint of a backlash from guests and owners on the use of large-scale travel platforms. Guests are becoming frustrated by overwhelming choice and data from the Professional Association of Self-Caterers Scotland showed that only 56% of self-catering owners used one of the major sites, with most relying on word of mouth or their own websites for visibility. This, of course, means dealing with Google, whose influence extends as deep into travel as it does into everything else.

Players and platforms

Before we consider some of the wider implications of tech in travel, let’s look at the options owners have for getting their self-catering place seen, the three mains one being large-scale OTAs, more niche local versions or recommendation sites. Each of these come with their own pros and cons in a changing market.

Big OTAs

Online Travel Agencies (OTAs) are the most common web-based marketplace, with two big beasts, Booking.com and Airbnb, dominating the market to the extent that the latter has morphed into a generic term for a whole type of accommodation. Although good for visibility in a way, they lack any element of curation and arguably overwhelm prospective guests with choice. They also come with high commission rates (from 3-25%), payment delays and pressure to accept cancellation terms that put an owner at serious risk of loss of income.

Niche platforms

Like pebbles between the boulders of the giant OTAs, there are many local platforms which replicate the mechanisms of the big players, but with the added specificity of location or place type, which makes guests’ lives easier by removing a layer of the search journey. While these seem a safer bet for owners worried about the quality of representation from the larger players, they are often operating at the limits of viability and can put revenue at risk. There’s also a chance of them getting swallowed up by larger companies.

Recommendation sites

Recommendation sites like Sawday’s offer guests a curated collection of places and a trusted opinion for guidance when booking. Membership models mean no commission on bookings and direct contact with guests. Platforms like this are an extension of an owner’s website, giving them the freedom to run their business how they want to. They might not bring the volume of traffic of the larger sites, but the focus is on delivering the right type of guests and the reach is still far larger than most owners can achieve alone.

Direct bookings & the impact of Google

Many owners would prefer to take bookings through their own website and operate independently of any third party, but according to market research company Mintel, Google’s entrance to the travel sector is, “significantly altering the holiday rental property market’s competitive dynamics.” Even Airbnb and Booking.com are still beholden to the search engine giant, unable to get guests using their own sites exclusively when Google offers such a broad playing field. It’s estimated that the travel industry spends around $16bn a year on Google advertising and the Expedia group got over a million more visits from paid ads on Google in 2021 than they did in 2019. What chance does an independent owner have of achieving any kind of visibility on their own?

The end result – market saturation?

All of the above, along with the pandemic causing a staycation craze, have created a supply boom in recent years that has pushed the self-catering industry the point of saturation, with guests bewildered by choice.

A recent BBC investigation found that the number of holiday homes in the UK has risen by 40% in the last 3 years, while Airbnb ended 2022 with 6.6million active listings, the highest in their history. Curated collections and industry experience are more important than ever, as guests look for trusted voices to cut through the white noise. Our 2020 audience research found that ‘recommending great places to stay’ and ‘championing independent owners’ were two of the most important factors to our guests. With a bewildering array of places available to guests, the challenge for owners becomes not juggling multiple booking platforms as it once was, but picking the one that will connect them to the right people.